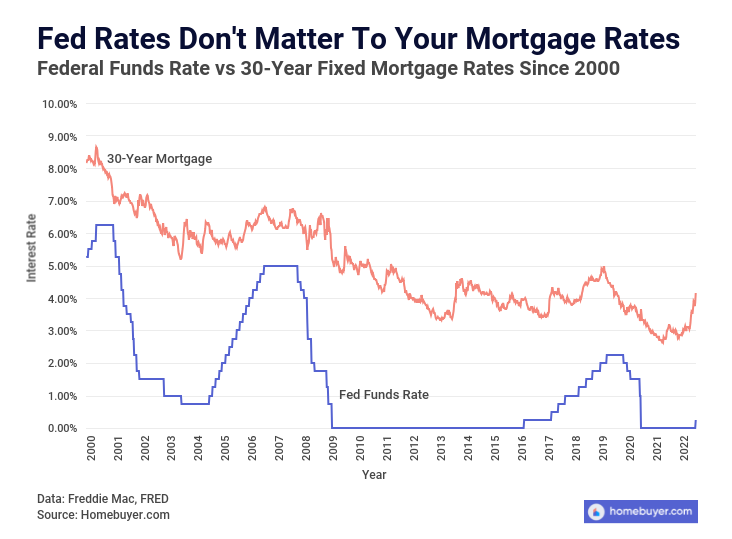

It may feel counter-intuitive to see mortgage rate going down when Fed raises rate. This is because mortgage rates are not directly impacted by Fed rate, but rather moves with 10-year Treasury yield. And, since Treasury notes are often used as a recession-hedge, people buys into 10-year treasury when worried about a possible recession. This will in turn drive down the associated yield (more demand, less payout), and taking mortgage rate down with it. Please note that mortgage rates fluctuate especially in the volatile market like the one we’re in.

So, what happens to mortgage rates in a recession? Consumers tend to tighten spending, and avoid taking out mortgages. And, lenders end up with excess reserves which would bring down the mortgage rate. But, of course, you knew that.

No, I don’t think we should all wait till the rates drop. For your home purchase, we can usually find solutions to the “quantitative” factors such as mortgage rate. For instance, there are mortgage programs that may suit your needs today while hedging yourself against possible rate-changes. The ultimate decision has to be based on the needs of “you and your family”.

Today may actually be the best time to buy (when others are hesitating). And, this is especially true for the first-time home buyers.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link